2025知到答案 Fundamental International Taxation(浙江大学) 完整智慧树网课章节测试答案

第一章 单元测试

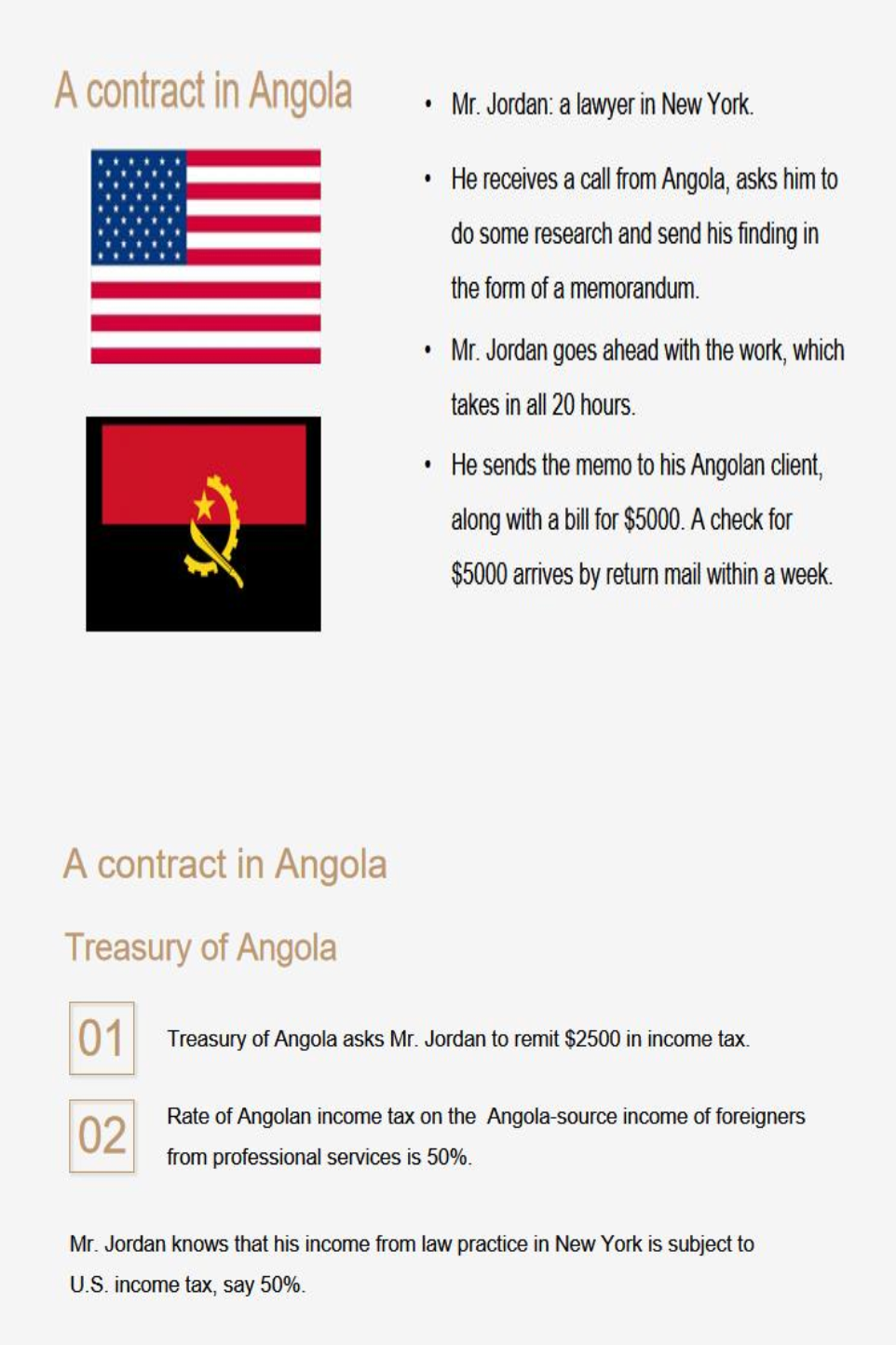

1、单选题: In this example, why does the Angolan Ministry of Jordan to pay income tax? ( )

In this example, why does the Angolan Ministry of Jordan to pay income tax? ( )

选项:

A:Income takes its source from the place of the economic activity that gives rise to it

B:Income takes its source from the place of the economic activity was done

C:The Angolan tax system identifies the source of income with the source of payment

D:The Angolan tax system identifies the place the underlying work was done

答案: 【The Angolan tax system identifies the source of income with the source of payment】

2、多选题:

Which of the following countries are tax havens?( )

选项:

A:Netherlands

B:Bermuda

C:U.S.

D:China

答案: 【Netherlands;

Bermuda】

3、多选题:

What are the Basic Elements of International Taxation?( )

选项:

A:International Transfer Pricing

B:Nationality and Residence for Taxation

C:The Source of Income

D:Arm’s Length Pricing Methods

答案: 【International Transfer Pricing;

Nationality and Residence for Taxation;

The Source of Income;

Arm’s Length Pricing Methods】

4、判断题:

Territoriality means that a country may claim that all income earned by a citizen or a company incorporated in that country is subject to taxation. The income includes domestic income and foreign income. This is because nationality is viewed as a legal connection to that country. ( )

选项:

A:对

B:错

答案: 【错】

5、判断题:

Capital export neutrality (CEN) requires residents of any given nation to face the same tax burden no matter where they choose to invest. A taxpayer’s choice between investing capital at home or abroad is not affected by taxation. ( )

选项:

A:对

B:错

答案: 【对】

第二章 单元测试

1、判断题:

For the bona fide residence test,the intention and the purpose of your trip doesn’t matter. ( )

选项:

A:错

B:对

答案: 【错】

2、判断题:

Strict 183-day rule takes into account not only time spent in the US during the calendar year, but also days spent in the two preceding calendar years.( )

选项:

A:错

B:对

答案: 【错】

3、多选题:

Which of the following belongs to the taxpayer( )

选项:

A:resident

B:administrative organs

C:citizen

D:corporation

答案: 【resident;

administrative organs;

citizen;

corporation】

4、多选题:

Which of the following persons are exempt individuals? ( )

选项:

A:consular officials

B:full-time diplomats

C:trainees

D:teachers

答案: 【consular officials;

full-time diplomats;

trainees;

teachers】

5、判断题:

The NPV rule is we accept the project if the net present value is larger than 0. Sometimes we will use ranking criteria when there are consider. You should choose the project with the highest NPV as your best shot.( )

选项:

A:错

B:对

答案: 【对】